THE WHAT? Arkhouse Management and Brigade Capital have put forward a significant proposition to acquire Macy’s for $5.8 billion, aiming to privatize the iconic department store chain. This move includes a plan to purchase Macy’s shares at $21 each, a notable increase from the previous Friday’s closing price of $17.39. The announcement of this offer had an immediate impact on the market, with Macy’s shares escalating to $20.13, marking an approximate 16% rise.

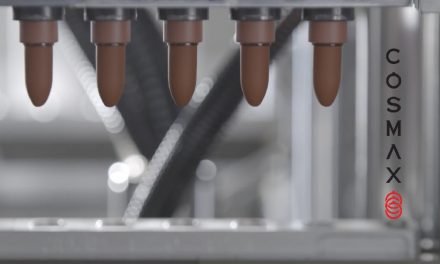

THE DETAILS The bid for Macy’s is backed by considerable interest and investment from the proposing parties, Arkhouse and Brigade, who already possess a substantial share in the company. This interest is further amplified by the high valuation of Macy’s real estate assets, including the famed Herald Square location, estimated at around $8.5 billion. Despite the ambitious nature of their initial offer, Arkhouse and Brigade have expressed willingness to adjust the bid following more detailed evaluations of the company’s worth. This openness to negotiation is set against the backdrop of Macy’s recent strong financial performance, particularly in its beauty products division, and its current market capitalisation of about $4.77 billion.

THE WHAT? The rationale behind this substantial offer by Arkhouse and Brigade appears to be twofold: an acknowledgement of Macy’s undervalued status in the public market and a strategic interest in its lucrative real estate portfolio. The investors’ readiness to reassess their bid post due diligence suggests a keen interest in ensuring a fair valuation that reflects Macy’s market potential and asset worth. This approach, however, is not without its challenges, as highlighted by Arkhouse’s previous failed bid of $2.4 billion for Columbia Property Trust.